No longer just the keeper of numbers, today’s CFO must be the engine of value creation, the sentinel of risk, and the architect of a future-ready finance function. This shift demands an expansion of their influence and accountability.

As stewards of capital, CFOs must cut through the noise surrounding AI, insisting on clear, measurable returns from every investment. AI can’t remain an experiment or side project – it must be treated as a strategic priority, underpinned by financial discipline.

As guardians of trust, CFOs also shoulder the responsibility of managing new risks: algorithmic bias, data breaches, and compliance failures that could inflict serious financial and reputational harm. Their vigilance will be key as AI becomes embedded in business operations.

But beyond defence, CFOs now face a rare opportunity to lead. By embracing AI, they can break free from outdated processes and reinvent finance – achieving new levels of efficiency, insight, and strategic influence.

The CFO’s Seat at the AI Table: From Cost Savings to Strategic Leadership

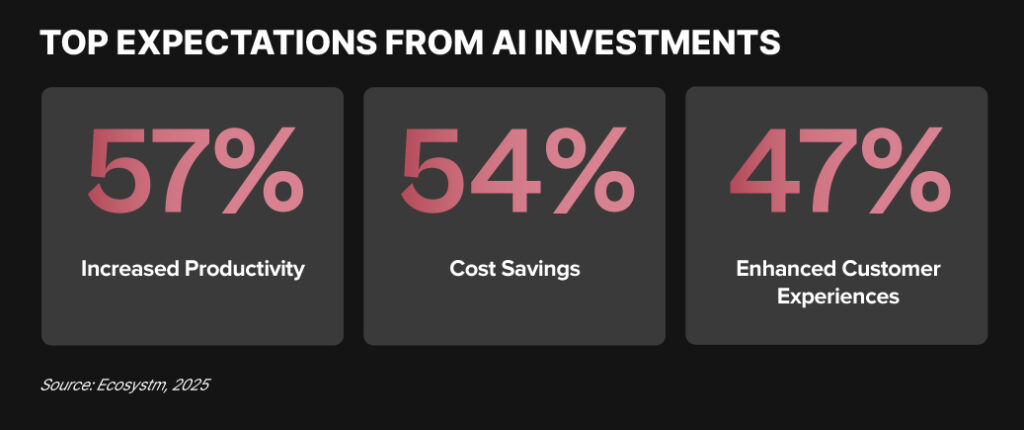

Organisations turn to AI for financial gains.

For many businesses, its appeal lies in promises of streamlined operations, fewer manual errors, and smarter resource allocation. Cost savings remain a top driver, placing AI firmly on the CFO’s agenda. As financial stewards, CFOs are naturally charged with finding strategies that boost efficiency and profitability.

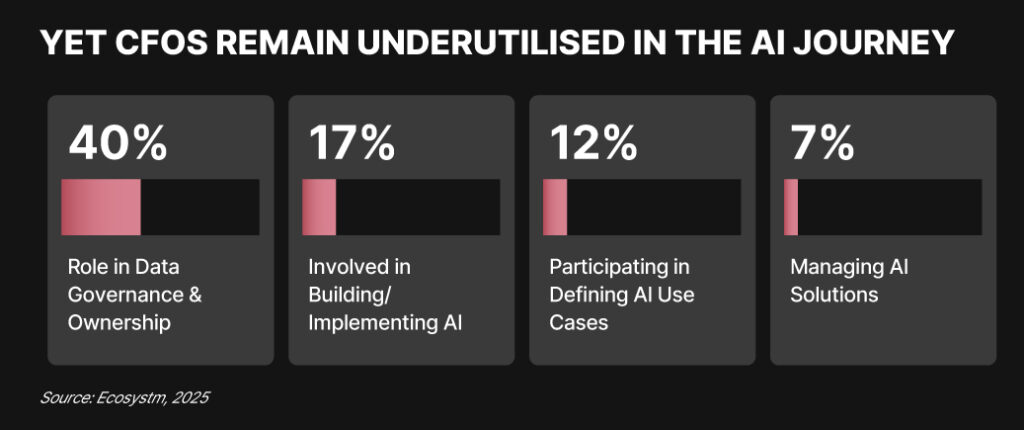

Despite AI’s financial implications and growing impact on business models and risk, many organisations have yet to fully tap into the CFO’s expertise. This is a missed opportunity. With their unique vantage point – spanning cost control, risk management, investment discipline, and the ability to convert technology into measurable value – CFOs are ideally positioned to anchor AI strategy.

Involving finance leaders from the outset ensures AI projects rest on solid financial foundations, deliver clear ROI, and are protected against hidden risks. AI is more than a technology play; it’s a business transformation and CFOs are critical to steering it towards sustainable, profitable outcomes.

The CFO Playbook for AI Success

Lead with Rigour: The Investor & ROI Gatekeeper

- Ensure Robust Business Cases. Every AI initiative must clearly define the problem it solves, the expected and measurable gains (cost, efficiency, accuracy), and trackable KPIs.

- Focus on High-Impact ROI. Prioritise projects with tangible results. Begin with quick wins that offer strong returns and manageable risk before scaling bigger initiatives.

- Understand Total Cost of Ownership. Look beyond upfront costs. Factor in integration, maintenance, training, and ongoing AI model management. Only 37% of Asia Pacific firms invest in FinOps – an area where CFOs can make a real difference.

Safeguard with Vigilance: The Risk & Compliance Steward

- Monitor for Bias & Strengthen Privacy. Regularly review AI models to reduce bias, particularly in sensitive financial processes, and secure financial and personal data to maintain compliance and trust.

- Build Resilient Security Defences. Acknowledge AI’s dual nature. Strengthen cybersecurity to guard against new threats, protect financial systems, and safeguard reputation.

Champion with Vision: The AI Advocate & Business Transformer

- Spot High-Value Use Cases. Collaborate with finance teams to pinpoint AI solutions that address real challenges—from automating accounts payable to enhancing forecasting and fraud detection.

- Promote AI Literacy. Empower finance teams to see AI as a tool for growth, not a threat. Support upskilling to close gaps in data management, model governance, and analytics.

- Establish Strong Governance. Create clear structures with defined roles and controls to ensure AI is deployed responsibly and effectively across finance.

- Look Ahead and Stay Engaged. Track emerging technologies that can improve finance operations and build partnerships to accelerate adoption and drive real results.

CFOs: From Gatekeepers to Growth Drivers

The future of AI-powered finance isn’t about marginal gains – it’s about reshaping the function entirely. CFOs have the mandate and the moment to elevate finance from back office to the front line of business transformation.

By applying financial discipline to AI investments, setting new benchmarks for responsible use, and empowering teams with the right capabilities, CFOs can transform AI from buzzword to catalyst, fuelling smarter decisions, driving innovation, and creating enduring value.

Now is the time for finance leaders to step forward – not just as gatekeepers, but as architects of an AI-enabled future.